Cart & Checkout

About Invoices and Receipts for Paid Orders

Invoices and receipts are important financial documents that serve different roles in your business. You can generate invoices or receipts automatically after payment is received.

This article explains each document and can help you decide which one you should send customers after a sale.

Tip:

You always have the option of manually sending a receipt or an invoice after payment.

What is an invoice?

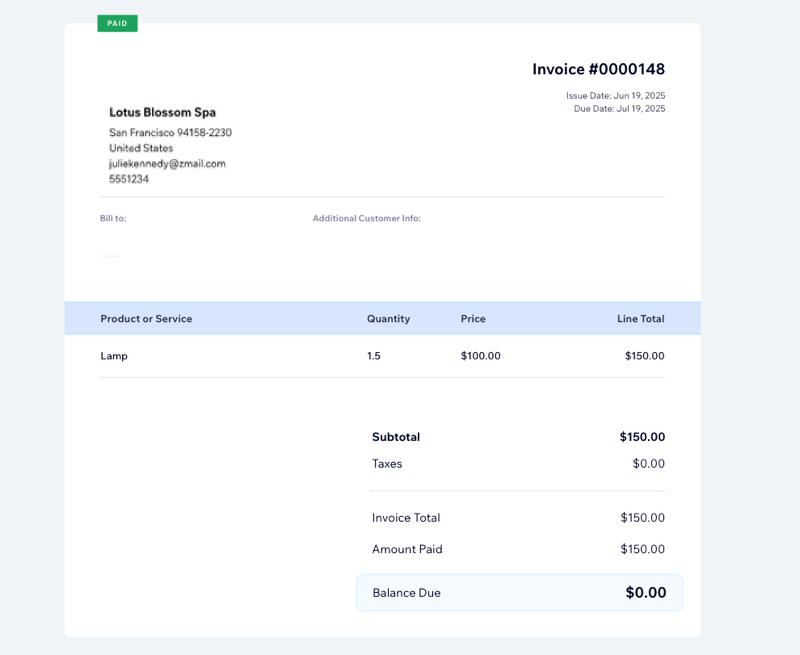

An invoice is a document that lists the products or services provided, their quantities, prices, and payment terms, as well as details about the seller and buyer. It's an official record for both you and your customer.

Usually, you send an invoice before delivery as a formal, legal request for payment, however, you can also send it after payment is received.

What is a receipt?

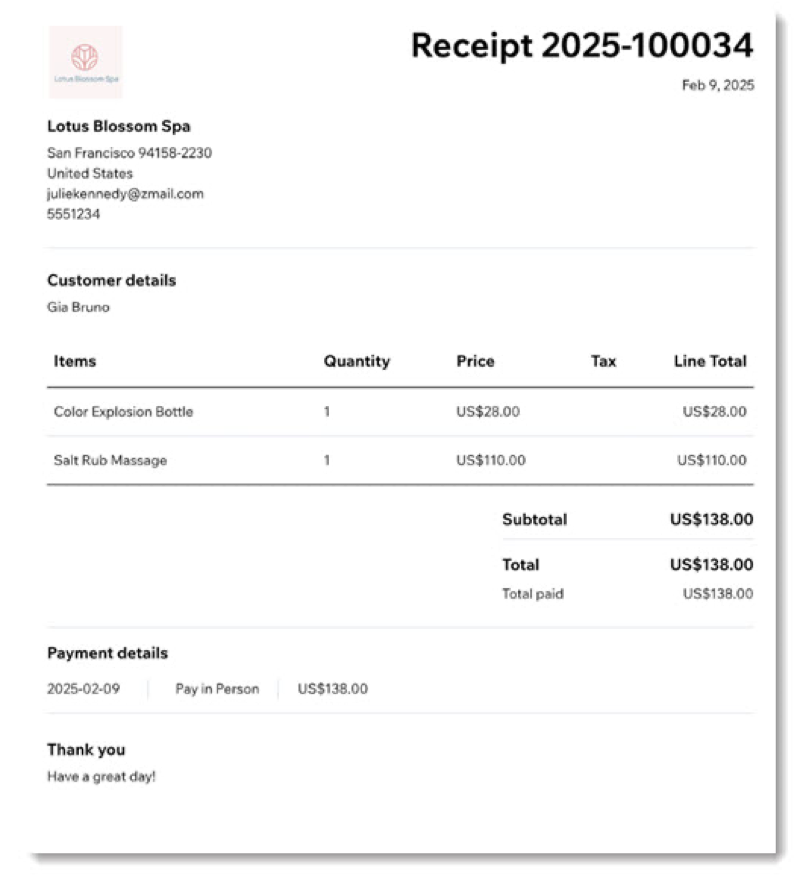

A receipt lists the products or services provided, their quantities, prices, and payment terms, as well as details about the seller and buyer, similar to invoices. They can help both merchants and customers with accounting and tax records.

Receipts prove that a transaction took place. As opposed to invoices, we automatically issue receipts after a payment is received, never before.

Choosing between issuing receipts or invoices

If you want to enable automatic receipts or invoices, we recommend choosing one or the other to prevent payments appearing twice in your records. If you simply want to provide proof of payment, in most cases, you'll want to issue receipts. However, there are a number of instances where invoicing may be useful instead of or in addition to receipts.

Payment and receipt logic

Invoices are issued per order for the full payment amount, while receipts are issued per payment.

If an order is paid with multiple payments, a separate receipt is issued each time a payment is received.

Invoicing required for all sales

Certain countries or regions require invoices for all sales, including paid orders. Check with your accountant or local tax authorities to see if this regulation applies to you.

Reconciling invoice numbering before and after payment

Every time you issue an invoice in Wix Invoices, each invoice gets a unique, consecutive number. If a final invoice is created automatically after full payment, it keeps the same number as the original invoice request. Some local authorities require this for accounting or legal reasons.

Note:

Receipts have their own unique, consecutive numbering which do not align with invoicing numbers.

FAQs

Do I need to make my invoices VAT-compliant if I’m in the EU?

If you're located in the EU, make sure your invoice is VAT-compliant. This is required for charging VAT properly, allowing buyers to reclaim VAT, and for maintaining proper accounting and tax records.

Tip: Check with your accountant or local authorities for information relevant to your place of business.

Can I enable both automatic invoicing and automatic receipts?

While it is technically possible to enable both automatic receipts and invoice for every paid order, this may cause single sales to appear twice in your financial reports, leading to an over-reporting of revenue.

We recommend enabling either one or the other.

Do receipts and invoices have legal standing?

Receipts are used to prove a payment was made, but may not always be enough alone for accounting or tax purposes. Invoices are more commonly required for formal tax and accounting records.

Tip: Requirements can vary by country and business type. Check with your accountant or local tax authority for details.

Why do I have more receipts than invoices for some orders?

If a customer pays for an order in multiple installments or transactions, Wix creates one invoice per order but a separate receipt for each individual payment. This keeps your payment tracking clear and organized.